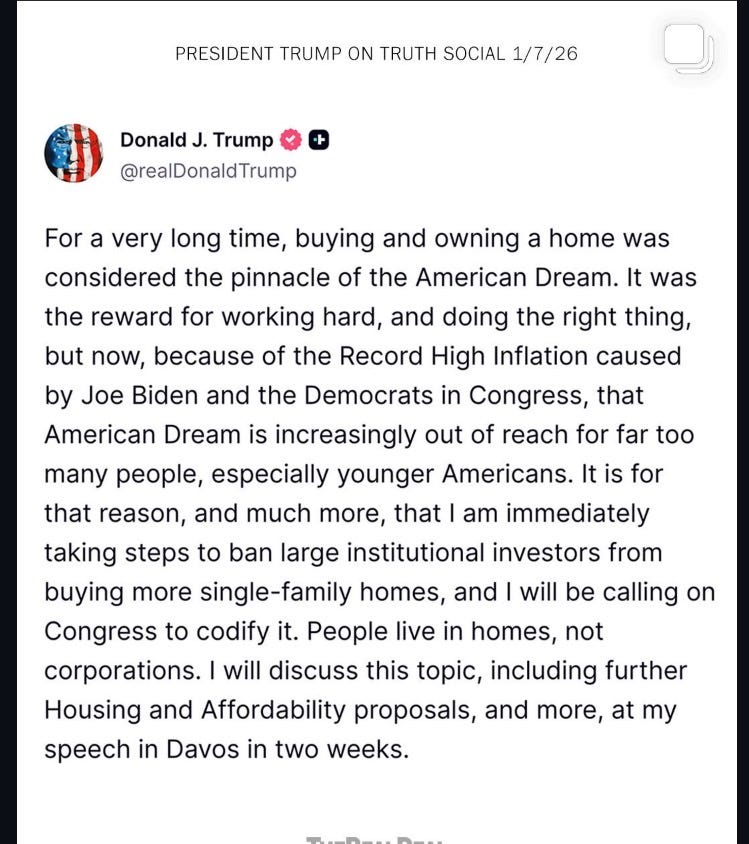

Trump to restrict corporate home purchases — but why?

For a policy that sounds bold and populist — see Trump’s tweet above on housing — it’s not actually clear what economic benefit comes from banning corporations from buying homes. If a corporation buys a house, it either rents it out or flips it — either way, someone ends up living in it. If too many homes get turned into rentals, then rents should eventually fall, which benefits renters and forces investors to sell. In a functioning market, these incentives tend to correct themselves over time.

What also gets ignored is that many of the properties corporations buy aren’t turnkey family homes at all. A large share are crummy, neglected, or distressed houses that require serious capital investment — or even teardown and full rebuild — before they’re usable. In those cases, institutional buyers are effectively bringing dead housing stock back onto the market. They create rentals — and eventually resalable homes — that were, in practice, already off-market because no individual buyer could realistically take on the risk or cost. That’s not crowding out families — that’s adding functional supply.

Which is why sweeping, top-down meddling in markets has such a bad track record. Housing is full of examples where well-intentioned intervention produced unintended and usually harmful consequences — distorted incentives, frozen mobility, stalled development, and less supply rather than more. Markets aren’t perfect, but they do adjust; centralized political fixes tend to break things in ways that don’t self-correct.

If the real concern is affordability, the problem isn’t that some firms buy houses — it’s that we have chronic supply scarcity created by zoning, permitting bottlenecks, and construction constraints. Restricting who is allowed to buy homes doesn’t fix that. It just treats a symptom while risking outcomes that make the underlying problem worse.