The Currency Model of Sociopolitical Communities

Sociopolitical communities work a lot like financial markets. Each one revolves around its own reputation currency — an underlying store of social value whose worth depends entirely on the confidence of the network. People trade in this currency through signals, slogans, posts, and public behaviors, moving value around as they seek to gain standing within the community.

When a new community suddenly bursts forth, it’s as if a new currency has launched. After October 7th, for example, the anti-Israel movement surged almost overnight, creating a brand-new reputation economy. People shifted their social capital, “selling off” value in other networks and “buying into” this one, hoping to get in early before the currency’s value exploded. It’s not so different from selling Bitcoin to buy a hot new altcoin — the appeal is the same: a chance to rise with a rapidly inflating asset.

Once invested, people rush to signal allegiance — changing profile pictures, sharing slogans, amplifying memes — not because they’ve carefully reasoned their way to a new worldview, but because signaling earns them more reputation value within the new network. These actions are less about persuasion than positioning: they’re ways to accumulate standing as the currency appreciates.

Yet we’re often blind to this dynamic. We rarely notice that the value of a currency — whether dollars, crypto, or reputation — ultimately rests on a single foundation: network confidence. Instead, we invent post hoc justifications that make the currency feel intrinsically valuable.

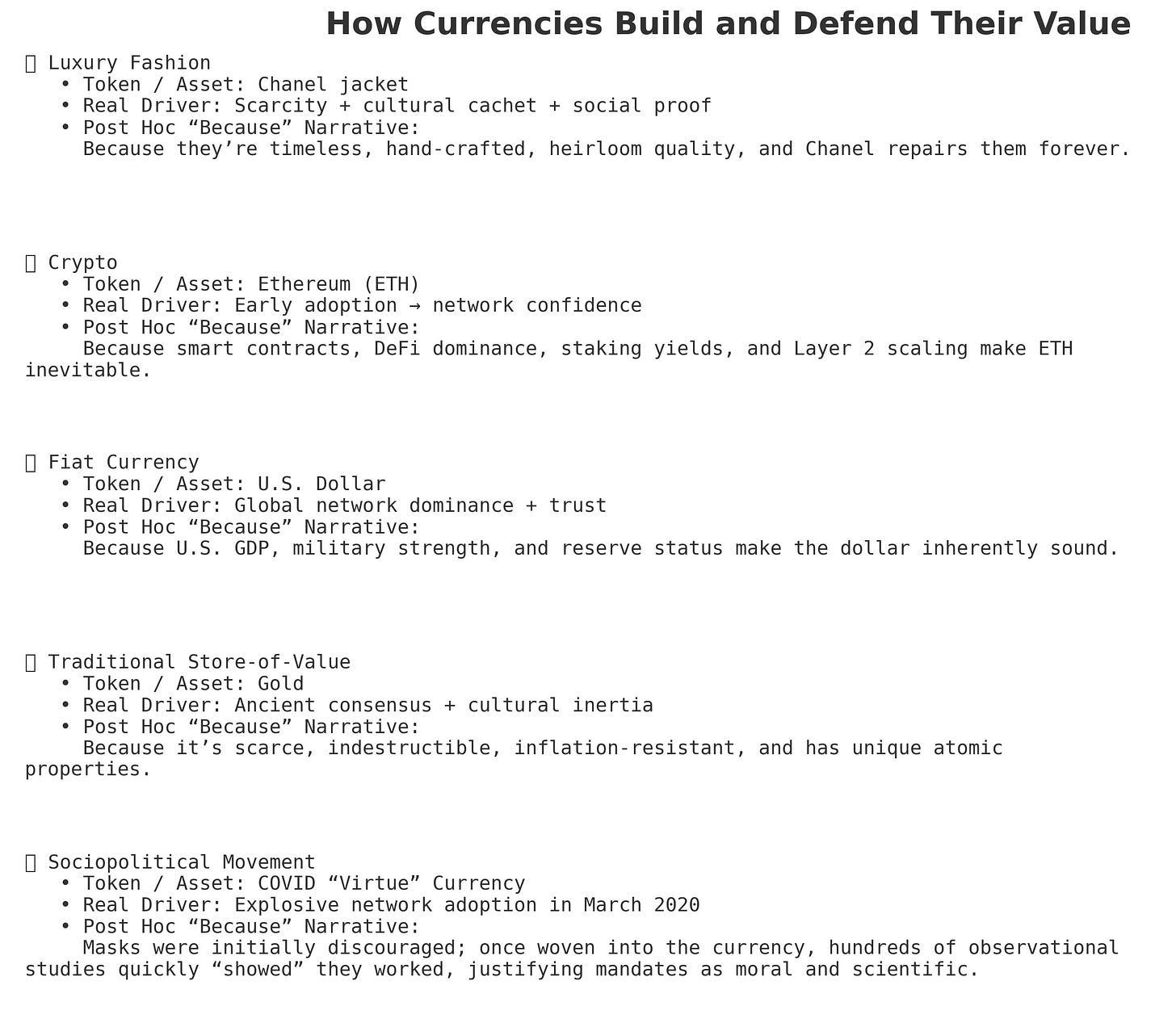

In finance, we tell ourselves the U.S. dollar is sound because GDP, military strength, and reserve status make it inherently safe. We believe Ethereum is inevitable because of smart contracts, DeFi dominance, and staking yields. In fashion, we justify a Chanel jacket’s price because of its timeless craftsmanship, heirloom quality, and infinite repairs. These stories are comforting, but they’re not the real reason these currencies hold value. They’re narratives built after the fact, designed to defend value once confidence already exists.

The same thing happens inside sociopolitical communities. When a new movement forms, people trade in its reputation currency, but the justifications take a different form: arguments about morality, truth, and justice. After 10/7, for instance, people didn’t just signal allegiance; they wrapped those signals in declarations about oppression, genocide, and ethics. It all sounds like principled reasoning — but structurally, it’s no different from defending the price of Ethereum or Chanel.

At first glance, these moral arguments seem like the cause of belonging. In reality, they’re closer to a consequence. Just as we defend the dollar by citing GDP or ETH by citing DeFi, we defend our sociopolitical communities by citing studies, slogans, and “facts” that explain why our “currency” is inherently valuable. These debates are rarely what they appear to be. The arguments, evidence battles, and moral philosophies are side effects of something deeper: the collective need to sustain confidence in the currency.

In the end, it all reduces to reputation value and network belief. Signals, memes, arguments, and displays are just transactions that move social value around, while the currency itself derives its worth entirely from the network’s shared confidence in its future. Across domains — whether crypto, luxury fashion, fiat money, or sociopolitical movements — the same pattern repeats.

We like to believe our positions come from reasoning. More often, our reasoning comes from the currencies we’ve chosen to hold. The arguments sound rigorous, but they’re illusions — downstream consequences of how markets, networks, and communities sustain themselves.